. . . if Pacifica were a jet . . .

Pacifica Executive Director Stephanie Wells spoke at the F25Aug2023 PLF, the Popular Liberation Front Pacifica Listener Forum (9:23-13:59). This regular get-together was created in late 2020 by Andrew Weiss, a KPFK listener-member, who often attends his local station board meetings but never seems to have run as a candidate – presumably following standard clinical advice. Besides ED Steph ‘The Breeze’, two other speakers were invited, Queen Liz III (KPFK listener-delegate, & director sleepwalker) & Eleanor Forman (WBAI listener-delegate). The meet got its one & only notice with less than 24hrs to go (sic) – moreover, if peeps wanted to ask questions, they were told to send them in beforehand (warrants another sic).

[UPDATE: audio recording sent out by PLF, Th31Aug: https://fccdl.in/bz9dsjLLTj.]

Although caught on their hindmost, the PacificaWatch minions managed to throw together some leading questions for Our Steph, & the carrier pigeon did the rest. It’ll come as no surprise to the zoologists observing the Pacifica ecosystem that the questions were rejected by the PLF high command. Things got even worse at the meeting itself: ED Steph did a Peñaloza – running away within minutes of arriving. Scooting away without even as much as a ‘bye, everyone!’, exuded in her ‘natural’ super-breezy way. (There being no sign of life when she was called upon by General Weiss at 46:20 & 57:52.)

The assembled, those who pay her $100k+ salary (plus benefits), were not best pleased. However, matters were redeemed somewhat by Ms Forman, who graciously, & to her great credit, chose to spend most of her allotted time voicing others: reading out, first, important remarks from Cerene Roberts (WBAI listener-member) on the delegates pseudo-elections (19:39-21:25), & then my own questions (1:06:58-1:11:29; given below). Bravo! As additional thanks, PacificaWatch is presenting to Eleanor an NFT courtesy of Pacifica’s financial mastermind, Lynden Foley, a prominent breaker about to make his return to the KPFT Local Station Board. This specially designed non-fungible token is a true rogues’ gallery, a digital collage of each & every Pacifica director sleepwalker from 2018 to present. ¡Magnífico!

~

[The questions, as submitted in good time, for the F25Aug2023 Pacifica Listener Forum meet; they’re followed by the supporting quotes, calculations, & links – and, inevitably, some commentary.]

These are 11 sets of questions put to ED Wells:

#1, why have you never publicly informed the members, listeners, and staff that Pacifica is defying California law by not having a chief financial officer, per Corporations Code, section 312(a)?

#2, Pacifica is a multi-million dollar public charity, yet it has under contract not even one CPA, a certified public accountant. Why have you never publicly appealed for the directors to instruct you to hire a CPA?

#3, Pacifica has defaulted on a federal $2M loan, EIDL, given on highly favorable terms, namely, 30 years at 2.75%. No monthly payment, of a mere $8,731, has ever been made. Why did you never publicly warn that default was imminent, and exercise leadership by calling for emergency fundraising?

#4, almost all Pacifica’s insurances were terminated on Monday, August 7. The board had met the previous Thursday, yet in your report you gave absolutely no inkling that this was a jeopardy. Why?

#5, the EIDL & insurances fiascos – as well as monthly net income statements being currently 11 weeks out of date – show that Pacifica is out of financial control. Why haven’t you been a leader – rather than being passive – and publicly warned that employing a CPA is the only way of having a chance to allow decision-makers to have timely and materially accurate financial data? [CORRECTION: a day shy of 12wks after period (only approved for distribution on Tu22Aug by the PNB Finance Cttee).]

#6, the California attorney general’s webpage says explicitly that no extension is possible for making public the audited annual financial statements: I quote, “The statute does not provide for an extension of time”, unquote. The deadline for those of FY 2022 was June 30 this year. Why have you repeatedly said in public – and it happened last year as well – that Pacifica has received an extension?

#7, Pacifica has a $2.7M loan from FJC. FJC’s public policy is that it never allows a loan to default because it sells any, and I quote, “potentially impaired loan”, unquote, to the Marty and Dorothy Silverman Foundation. As Pacifica has not paid the interest falling due since December 31 last year, why haven’t you reported publicly that FJC no longer owns the loan?

#8, FJC charged 18% interest when the December 31 quarterly payment wasn’t made, a then penalty of 7.5 percentage points. For how many days was this incurred, and at what cost? And why have you never disclosed these facts?

#9, through lack of payment, FJC has charged 18% interest since April 1. Interest at 18% annualizes as $486K (at $80K, that’s 6 full-time employees). Why haven’t you disclosed these facts?

#10, the California charities registry declares (even today), for any prospective donor to see, that Pacifica is delinquent. At the August 17 board meeting, you said this isn’t true, and that the registrar was simply tardy – although you cited neither a document nor a date of curing. You also agreed to put a statement of non-delinquency on the homepage of Pacifica’s website. You haven’t done this. Is it because Pacifica actually is delinquent, for a reason other than paying last August the wrong annual registration fee?

Lastly, #11, the Los Angeles land and building were removed from escrow two weeks ago. Why have you never disclosed this, not least in your public reports to both the board on August 17 and the board’s Finance Committee on August 8 and 22?

I look forward to your complete answers.

Thank you.

~

The supporting quotes, calculations, commentary, & links:

#1: why have you never publicly informed the members, listeners, and staff that Pacifica is defying California law by not having a chief financial officer, per Corporations Code, section 312(a)?

(a) “312. (a) A corporation shall have (1) a chairperson of the board, who may be given the title of chair of the board, chairperson of the board, chairperson, or a president or both, (2) a secretary, (3) a chief financial officer, and (4) such other officers with such titles and duties as shall be stated in the bylaws or determined by the board and as may be necessary to enable it to sign instruments and share certificates. […]” – CA Corporations Code, § 312(a), emphases added … https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?sectionNum=312.&lawCode=CORP; &

(b) the unsurprising meaning of “shall” in this CA law: “15. ‘Shall’ is mandatory and ‘may’ is permissive.” – § 15, emphases added … https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=CORP&heading2=GENERAL%20PROVISIONS

. . . the law doesn’t say,

‘if you’re short of cash, but want to keep *spending 54% of your station personnel costs favouring just one station* amongst five (per the Feb2023 net income statements), then there’s no prob, no prob whatsoever, just carry on, carry on regardless, & the law will make a special exception for you, & treat you differently from the rest of the world, the law will grant you the special privilege you’re obviously entitled to – and damned be the donors to Pacifica Foundation, Inc. who think the law should protect them & their donations from decisions made by directors & their senior managers’.

Station personnel costs (the 5mths thru Feb2023): KPFA $1 063 553, KPFK $374 392, KPFT $11 018 (sic), WPFW $283 031, WBAI $248 220 … totalling $1 980 214 … so KPFA = 1063553 ÷ 1980214 = 53.708% … https://mega.nz/folder/RR8XmaAB#kEhHjAFTec2X_Z6CzAC5dw

“Mandatory”: such an un-Pacificese word. “So unfair!***!”, screams the director sleepwalker, throwing their rattle out the pram.

#2: Pacifica is a multi-million dollar public charity, yet it has under contract not even one CPA, a certified public accountant. Why have you never publicly appealed for the directors to instruct you to hire a CPA?

(a) Pacifica being an annual multi-million $$$ public charity: per the last audited data, for FY2021 its total revenue was $11.1m ($11 095 555) & its total expenses were $11.5m ($11 538 444) – https://pacifica.org/finance/audit_2021.pdf. However, over the last 24mths, Pacifica has become a much smaller operation, by ~20%: revenue down 19.5%, expenses down 21.7% (8933860 ÷ 11095555 =19.482; 9030724 ÷ 11538444 = 21.733). This is per the latest net income statement seen by PacificaWatch, that thru Feb2023, where total revenue annualises as $8.9m & total expenses as $9.0m (totals thru 5mths, $3 722 442 & $3 762 802, respectively; annualising as $8 933 860 & $9 030 724, respectively – note, the total expenses thru Feb2023 that are annualised omit both depreciation, & the Jan & Feb accrual of the FJC interest (& other expenses?!? – such as un-invoiced services from General Counsel Arthur Schwartz; interest is at line 67 of the Pacifica National Office, PNO, net income statement); & the annualised expenses also exclude the extra FJC interest charged since 1Apr for not making the 31Mar & 30June quarterly payments – and, no doubt, that falling due 30Sep). The monthly net income statements: https://mega.nz/folder/RR8XmaAB#kEhHjAFTec2X_Z6CzAC5dw; &

(b) Pacifica last had a CFO on Th22Sep2022: https://kpftx.org/archives/pnb/pnb220922/pnb220922a.mp3 (9:08), & https://pacificaradiowatch.home.blog/2022/09/29/neta-leaves-8-days-early-th22sep-replaced-by-markisha-venzant-sampson-the-queen-is-dead-long-live-the-queen-chop-kpfa-paid-staff-end-the-fiefdoms-use-network-development-plan/

#3: Pacifica has defaulted on a federal $2M loan, EIDL, given on highly favorable terms, namely, 30 years at 2.75%. No monthly payment, of a mere $8,731, has ever been made. Why did you never publicly warn that default was imminent, and exercise leadership by calling for emergency fundraising?

(a) Terms & conditions of a COVID-19 Economic Injury Disaster Loan, https://www.sba.gov/funding-programs/loans/covid-19-relief-options/covid-19-economic-injury-disaster-loan/about-covid-19-eidl (on balance, for the borrower, the new form of the EIDL offered during the epidemic was even better than its predecessor – and yet the directors sleepwalkers have allowed such a lack of financial control that ED ‘The Breeze’ couldn’t even prioritise keeping that loan alive, rather than defaulting without ever making a monthly payment – sic); &

(b) the monthly charge of $8 731, three of them, per ED Wells’ “$26 193” (53:21), Tu8Aug2023 PNB Finance Cttee – extracted like blood from a stone, as all info re the EIDL was studiously excluded by ED Wells from her report, it only being revealed coz she was asked a direct Q, a full 20mins after she had started speaking (33:40) – sic (one can understand why in some legal codes there’s the concept of economic sabotage) . . . so her preference was to keep it all from the Cttee, & the public, to conceal the fact that Pacifica had not only defaulted on a federal loan but that the Small Business Administration had washed their hands of Pacifica, & it was now all with the collections department of Uncle Sam (bless us & save us): “[p]ayments have not been made on the EIDL loan [ED Wells means ‘have never been made’]. Um, we have been formerly advised that we are in default of the loan”, a “$2.080M payoff amount” (principal + interest + sundries, & to be augmented by Sam Eagle’s legal expenses & court fees), all administered on behalf of the people by “the US Treasury collections department” (53:32; this being the Treasury’s Bureau of the Fiscal Service) – https://kpftx.org/archives/pnb/finance/230808/finance230808a.mp3, & https://fiscal.treasury.gov/cross-servicing/ . . . the supine Chair James Sagurton (WBAI listener-member) himself studiously chose the cowardly route, not including the EIDL default in his own instituted agenda item, ‘Chair’s announcements’, hoping that no-one would mention what was obviously an open secret amongst the directors sleepwalkers, absurdly leaving an open goal for an arch-breaker like Sharon ‘if you think I’m nasty, you should see the other Berkeley hillbillies’ Adams, KPFA Treasurer, salivating as she readied to pounce with her barbed question. (Member ‘Supine’ Sagurton is LARP’ing as a delegate coz he’s a squatter on both the WBAI Local Station Board & the Pacifica National Board, having exceeded the 6yr mandated limit (in fact, it’s a mandate like no other in the Pacifica by-laws, its wording unique: “in no event more than […]”, emphases added) – https://pacifica.org/indexed_bylaws/art4sec8.html.)

#4: almost all Pacifica’s insurances were terminated on Monday, August 7. The board had met the previous Thursday, yet in your report you gave absolutely no inkling that this was a jeopardy. Why?

(a) Report by ED Steph ‘The Breeze’ to Th3Aug2023 PNB: exactly 90secs, with no questions asked (sic; 2:30:41-2:32:11), just the way everyone likes it – even though this uncritical culture is the Pacifica correlate of Prigozhin’s jet … https://kpftx.org/archives/pnb/pnb230803/pnb230803a.mp3;

(b) then just 5days later, ED ‘The Breeze’ detonates the bomb, & they all watch the insurances go up in flames: “[w]e were informed yesterday by our insurance brokers, um, that as of late yesterday afternoon [M7Aug], a majority of the insurance policies for Pacifica have been cancelled due to non-payment. Um, we still have our workmen’s comp insurance, and we still have the health insurance, again thanks to the generous, urgh, support from KPFT, and also the funds of, um – the dollars of WBAI, and also the National Office. So what has been cancelled due to non-payment is the earthquake insurance in Los Angeles; the equipment insurance for all of the stations, including broadcast, studio and towers; the property and casualty insurance; the general liability insurance; the excess liability insurance; and the media liability insurance” (40:24, emphases added), Tu8Aug2023 PNB Finance Cttee – https://kpftx.org/archives/pnb/finance/230808/finance230808a.mp3;

(c) no Pacifica decision-maker has mentioned how much money is involved here, namely the size of the annual insurances expense – not one of the 21 directors sleepwalkers nor one of the 101 other delegates. So here they are for the last five complete fiscal years, plus the current one thru Feb2023 (annualised):

| Fiscal year | Insurance expense ($) |

|---|---|

| 2018 (unaudited) | 232 110 |

| 2019 (unaudited) | 199 883 |

| 2020 | 185 349 |

| 2021 | 219 313 |

| 2022 (unaudited, per consolidated statement – total column) | 88 892 (sic) |

| 2022 (unaudited, per consolidated statement – summation of monthly columns) | 221 691 (sic) |

| 2022 (unaudited, per unit statements, PNO + KPFA + KPFK – summation of monthly columns) | 223 177 (sic) |

| 2023 (unaudited, $43 236 thru Feb2023 per consolidated statement; annualised) | 103 766 (sic) |

| 2023 (unaudited, $54 967 thru Feb2023 per unit statements, PNO + KPFA; annualised) | 131 921 (sic) |

(i) Sources: annual auditor’s reports FY2018-FY2021 (see auditor’s letter, & penultimate page); & Feb2023 set of net income statements (for FY2022 & FY2023; note, re FY2022, as with all the other line items, no annual totalling (sic) by the preparer, National Business Manager/Creditor Hotline Clerk/Junior-Juggler-in-Chief Markisha ‘you haven’t seen me, right?’ Venzant-Sampson: the total column is not the year but only thru Feb2022, as a comparative – & she mislabelled the heading twice: the consolidated & KPFA statements are given as “Total Prior Year” – sic) – https://pacifica.org/finance_reports.php, & https://mega.nz/folder/RR8XmaAB#kEhHjAFTec2X_Z6CzAC5dw

(ii) FY2018 & FY2019 are denoted unaudited coz the auditors tried to do an audit but because of what they found – and couldn’t find – they concluded that they were unable to provide an opinion on the material accuracy of the financial statements (so including the insurance expense datum) presented to them by Pacifica’s management (the auditors’ jargon is issuing ‘a disclaimer of opinion’ – the only other time this happened to Pacifica was FY2017); FY2022 is unaudited coz the audit hasn’t even started (sic); & FY2023 hasn’t ended yet (the procession of the monthly charge, per the consolidated statement, is revealing: $12 223, $16 900, $11 498, $1 308, $1 308 – shoddy bookkeeping or non-renewed/terminated policies, or a combo? No scrutiny of this tell-tale disjuncture was offered by those who have the responsibility to check the statements for obvious errors & surprises: missed by the 10 on the PNB Finance Cttee (sic), so, not spotted by five directors sleepwalkers, eluding five station treasurers … Finally, the annualised total will be reduced by ~8wks’ worth of terminated policies – an amount undisclosed, & passed by in silence, yet another ship in the night)

(iii) since NETA left on 22Sep2022, the monthly net income statements have been a complete mess – in all of timeliness, frequency, content. The insurances expense is an example: the presentation of both the FY2022 & FY2023 total differs depending on where you look! Re FY2022, the consolidated total ($221 691, line 85) doesn’t agree with the aggregated unit total of $223 177 (PNO, $211 237 (charge each month), line 66 + KPFA, $10 254 (charge only Mar-Sep2022), line 69 + KPFK, $1 686 (charge only Oct2021), line 59). Re FY2023, the consolidated total ($43 236, line 85) doesn’t agree with the aggregated unit total of $54 967 (PNO, $48 428, line 66 + KPFA (earthquake insurance – ED Steph ‘The Breeze’ (42:16), Tu8Aug2023 PNB Finance Cttee, https://kpftx.org/archives/pnb/finance/230808/finance230808a.mp3), $6 539, line 69). Unbelievable; &

(d) [UPDATE: and the cost of restoring these insurances? No-one volunteered the info. And it took over 4wks before anyone asked (sic). ‘The Breeze’ hadn’t taken the initiative, making it plain to all the scale of the problem – no, ‘The Breeze’ dribbled it out in response to a direct Q – another one: see the behavioural pattern? – at the Th7Sep PNB, & even then it was a Q that had to be asked twice (sic): “a couple o’ hundred thousand dollars“, she said (2:08:29, emphases added) – https://kpftx.org/archives/pnb/pnb230907/pnb230907a.mp3. ‘The Breeze’, as passive as ever. The young child & the shiny object: cover it up, it disappears. Bless us & save us; blood from a stone – see the behavioural pattern? A pattern condoned – and therefore encouraged – by the directors sleepwalkers.

[With being obliged to speak on it, ‘The Breeze’ did disclose how dire is the re-insurance problem: with some offers, Pacifica would “have to pay for all of it upfront, with an additional 25% [sic; …] So right now I think what we need to do is figure out what it is that we need [so ‘The Breeze’ is envisaging that Pacifica can cope without some of the insurances (sic)], and then see if the broker can find anyone that would be willing to cover us and take the, you kn’ – take that leap of faith that we will pay them” (2:09:58, emphases added).]

#5: the EIDL & insurances fiascos – as well as monthly net income statements being currently 11 weeks out of date – show that Pacifica is out of financial control. Why haven’t you been a leader – rather than being passive – and publicly warned that employing a CPA is the only way of having a chance to allow decision-makers to have timely and materially accurate financial data? [CORRECTION: a day shy of 12wks after period (only approved for distribution on Tu22Aug by the PNB Finance Cttee).]

(a) Distribution of the set of May2023 mthly net income statements was approved, without objection, by the Tu22Aug PNB Finance Cttee (‘c’-file, 16:27), so a day shy of 12wks after period (sic) – https://kpftx.org/archives/pnb/finance/230822/finance230822c.mp3; &

(b) NETA left on 22Sep2022, taking their certified public accountants with them. This seemingly left a qualifications void: Pacifica having no-one under contract with either an accountancy or bookkeeping qualification. No Pacifica position-holder, especially a director or employee, has ever claimed publicly that Pacifica has a qualified accountant under contract. Nor even a qualified bookkeeper – although some station people are said to do some bookkeeping. [UPDATE: the Tu12Sep “I don’t really give a shit, Jim” (Sharon Adams – 19:24) PNB Finance Cttee nightmare was the latest evidence of it being “some bookkeeping” (choose your own slice of the debacle) – https://kpftx.org/archives/pnb/finance/230912/finance230912a.mp3 (also a ‘b’-file).]

This void – a presence of absence – applies no less to the occupant of the post especially created when the directors sleepwalkers chose a new trajectory for Pacifica: flying blind financially with no frills whatsoever, not even flying by the seat of their pants – flying blind & naked. Sub-economy. Freezing in the wheel-house – approaching death, not refuge. Enter stage left, the inaugural National Business Manager, Markisha ‘I’m so calm I could be basking in the Gulf – and yes, I’m cooler than Cerene’ Deshaun Venzant-Sampson. It’s true that Markisha has been associated for many years with KPFT’s bill-paying & bookkeeping, & the public record does show that her first degree included accountancy, & that she still advertises online as a jobbing contractor – but there’s no promotional spiel saying she has a professional qualification, bookkeeping or otherwise . . . oh . . . and no-one else has ever claimed it publicly on her behalf. https://www.zoominfo.com/p/Markisha-Venzant-sampson/7343475771; & https://en.wikipedia.org/wiki/ZoomInfo (nothing to do with the online conferencing company) & https://www.yptc.com/

. . . directors are legally responsible for protecting charitable assets, & are personally liable – that’s why rational directors arrange the affairs of the charity so that money is ALWAYS allocated to hire that un-Pacifican guy, an expert, here a CPA, to establish & maintain the structure/function/practice of efficient fiscal management – always meaning that sometimes cherished expenditures have to be sacrificed, such as the current station personnel cost structure where KPFA takes 54% of the total . . .

Another presence of absence is that not one of the 120 delegates has even asked – let alone presented a motion – as to why this choosing by the directors sleepwalkers of a lack of fiscal management is even happening – let alone persisting – this occurring at a public charity taking in millions & millions of $$$ every year from Joe & Joanna Average. Fiscal management is not reducible to bookkeeping & accountancy, & the California Attorney General recognises this by placing it at the core of what it is to be a proper charity, devoting a whole chapter of the Attorney General’s Guide to Charities to ‘Exercising Fiscal Management’ (pp. 32-7). It includes concepts, rules, systems, protocols, procedures, practices (routine & episodic) never broached in Pacifica open meetings. https://www.oag.ca.gov/system/files/media/Guide%20for%20Charities.pdf (June2021)

So we get: “Exercising fiscal management […] responsible fiscal management […] Good internal controls […] mechanisms in place to keep it fiscally sound [… the directors’] approval of policies and procedures determines the fiscal management system. An effective internal control system includes budgets, segregation of duties, policy and procedures manuals, clear definition of and adherence to set procedures for management authority and control, and periodic review of the control system […] A realistic budget should be developed early enough so that the entire board can be involved in its review and approval before the beginning of the fiscal year. Management should produce accurate income and expense statements, balance sheets, and budget status reports in a timely manner ahead of board meetings [surprisingly, no mention of cashflow forecasts]. Directors should monitor the budget and anticipated revenue […] protect against internal fraud and fiscal mismanagement […] seek expert advice from a professional accountant to assist in designing and implementing the fiscal management system […] preventing internal fraud and theft of charitable assets […] Payment requests or requests for cash disbursement should be accompanied with invoices, receipts, or other documents showing the payments are justified and appropriate” – and that’s just from the first two pages of the chapter (sic).

. . . living as in a dream . . .

. . . sleepwalking into the chainsaw . . .

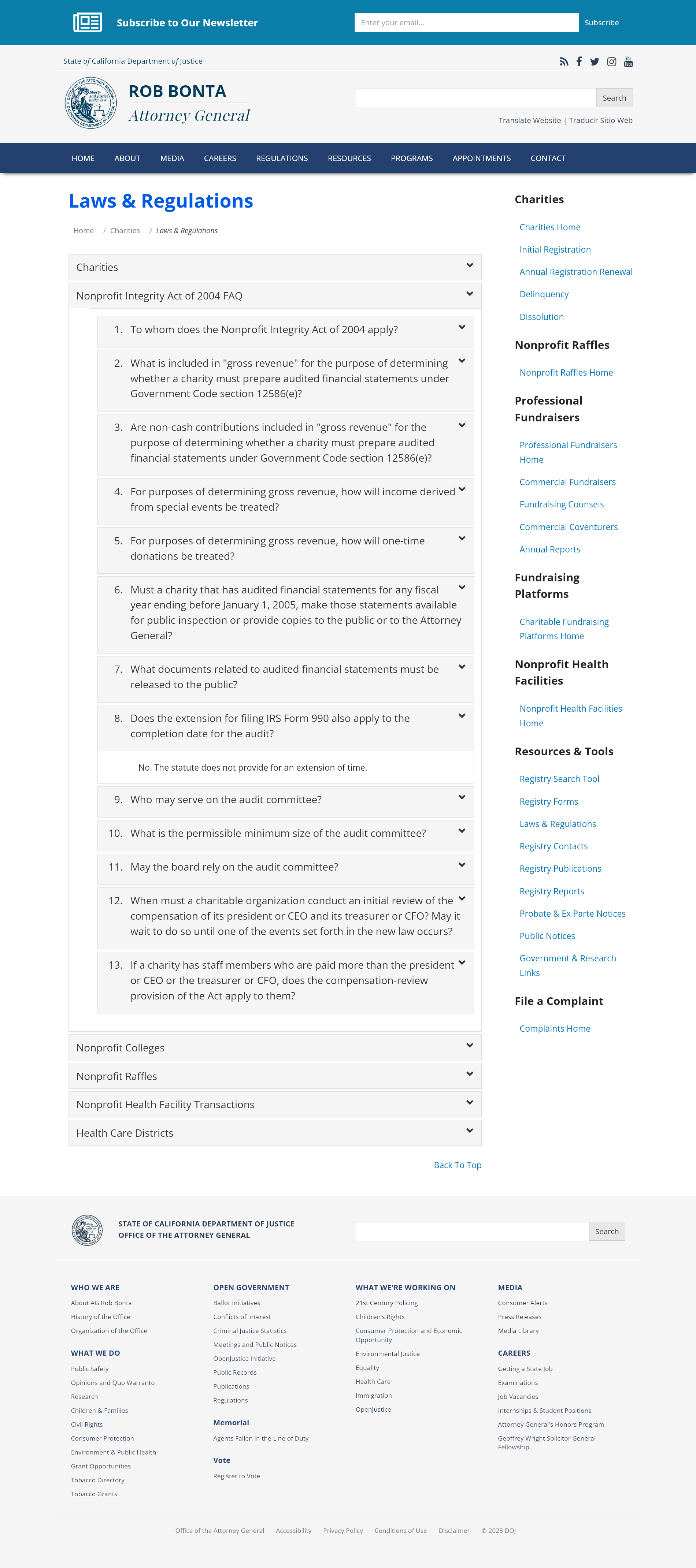

#6: the California attorney general’s webpage says explicitly that no extension is possible for making public the audited annual financial statements: I quote, “The statute does not provide for an extension of time”, unquote. The deadline for those of FY 2022 was June 30 this year. Why have you repeatedly said in public – and it happened last year as well – that Pacifica has received an extension?

(a) The California Attorney General is emphatic in their view: “[t]he statute does not provide for an extension of time” (emphases have to be added, i think you’ll agree), https://www.oag.ca.gov/charities/laws (in the section “Nonprofit Integrity Act of 2004 FAQ”, the CA AG’s answer to their question #8, “[d]oes the extension for filing IRS Form 990 also apply to the completion date for the audit?”). This unambiguous, unconditional statement warrants a screenshot coz the very opposite view has been asserted by none other than Pacifica’s Executive Director, Stephanie Wells: in Pacifica public meetings, July & Aug this year, she has claimed that Pacifica has been granted an extension – and she said the same thing last year, about the FY2021 financial statements.

Screenshot:

. . . California Attorney General speaking the plain truth: they don’t have the power to give an extension. The law isn’t designed to let the trustees of a charity off the hook: to allow the directors sleepwalkers to refuse to allocate money to hire a chief financial officer, hire a certified public accountant, to ensure good fiscal management, a refusal that ensures that the charity fails both the test of law & the test of courtesy, failing to demonstrate to donors (current & prospective) & the state that it can generate financial statements that are deemed materially accurate by a team of outside auditors – https://oag.ca.gov/charities/laws . . .

Here’s ‘The Breeze’ with her breezy delivery to the 17Aug PNB: “I was submitting another request this current year to – letting the Secretary of State know that we were going to be late in filing for our audit […] and they said no problem, you can, you know, we’re granting you an extension” (2:52:52, emphases added) – https://kpftx.org/archives/pnb/pnb230817/pnb230817a.mp3. The assertion by ‘The Breeze’ is actually twofold: (i) effectively saying that California statute law doesn’t apply to Pacifica, & (ii) literally saying that Pacifica has got explicit permission from the CA AG not to comply with the law. As quoted below, the effect of the law is making public by 30June2023 the FY2022 audited financial statements (plus, as an obvious courtesy, the auditor’s annual report). And her declarations are assertions because neither this year nor last, has she ever given details of these communications, be it by letter, email, or word of mouth, or even the dates – and no director sleepwalker has ever publicly asked her for this supporting evidence of her bland assertion;

(b) the law, “[…] The audited financial statements shall be available for inspection by the Attorney General and by members of the public no later than nine months after the close of the fiscal year to which the statements relate. […]” – CA Government Code, § 12586(e)(1), emphasis added … https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?sectionNum=12586.&lawCode=GOV (& Pacifica’s year-end is 30Sep – https://pacifica.org/finance_reports.php); &

(c) the crucial difference in CA law between shall & may – please see #1(b) above.

#7: Pacifica has a $2.7M loan from FJC. FJC’s public policy is that it never allows a loan to default because it sells any, and I quote, “potentially impaired loan”, unquote, to the Marty and Dorothy Silverman Foundation. As Pacifica has not paid the interest falling due since December 31 last year, why haven’t you reported publicly that FJC no longer owns the loan?

(a) The Foundation for the Jewish Community operates as FJC – https://pacificaradiowatch.home.blog/realworld-disciplines-pacifica/principal-creditors/foundation-for-the-jewish-community-operating-as-fjc/origin-of-fjc-s-name-and-acronym/. And the principal? Pacifica is currently “owing $2.7M to FJC” (ED Wells (24:34), Tu11July2023 PNB Finance Cttee – https://kpftx.org/archives/pnb/finance/230711/finance230711b.mp3);

(b) at the core of FJC’s public policy on loans is acting pre-emptively when a loan is judged “potentially impaired”: FJC doesn’t wait for a borrower to default; instead it sells the loan, without discount – see any of its annual auditor’s reports, such as the latest one, dated 11Oct2022, that for FY2022, thru Mar2022 (Note 2: pp. 9, 10-12; add one for the PDF numbering): “[i]n the event that FJC determines a loan to be potentially impaired, FJC will notify the private foundation that pledged securities to satisfy the loan that FJC intends to exercise its rights under the hypothecation agreement” (p. 11) – https://fjc.org/wp-content/uploads/2022/10/FJC-Audited-Financial-Statements-FY-2022.pdf … the policy allows FJC to (i) protect the investment made by its donor-advised funds accountholders, & (ii) avoid bad publicity, being seen to chase charities, etc. for its money, if need be thru the courts; &

(c) FJC sells these “potentially impaired” loans to the Marty and Dorothy Silverman Foundation, the main force setting up FJC in 1995. The latest disclosure by FJC of this policy is in its 2020 IRS Form 990, Schedule L: “Lorin Silverman is a director, president and treasurer of the Marty and Dorothy Silverman Foundation which has pledged to FJC a security interest in securities to be used as collateral for the repayment of principal amounts in the event of default of any FJC’s Agency Loan Fund receivables. This agreement remains in effect until October 1, 2022 and is renewable by mutual consent. As of March 31, 2021, the fair value of the collateral held as security under the pledge agreement was $20,003,840.” (p. 2, actually in all-caps; p. 103 of the PDF at https://www.charitiesnys.com/RegistrySearch/search_charities.jsp (pump in ‘FJC’, then click on ‘Annual Filing for Charitable Organizations 03/31/2021’); this info re MDSF being FJC’s lil helper doesn’t appear in its latest filing, that of the 2021 IRS Form 990, coz it lacked a Schedule L). (Lorin, the son, is, not surprisingly, also a director & the prez of FJC; his email for Pacifica queries is Lorin@ny830.com.) The nature of the Agency Loan Fund is discussed at https://pacificaradiowatch.home.blog/what-fjc-has-made-pacifica-do/ (posted July2019).

#8: FJC charged 18% interest when the December 31 quarterly payment wasn’t made, a then penalty of 7.5 percentage points. For how many days was this incurred, and at what cost? And why have you never disclosed these facts?

(a) Not paying the quarterly interest “within five (5) days after the date when due” counts as “an Event of Default” (Section 8.1 of the ‘root’ loan agreement, p. 13; add one for the PDF numbering). (Another ‘event of default’ is, not surprisingly, “Borrower’s failure to maintain insurance” – Sec. 8.2, same page.) Re the penalty, “‘Default Rate’ means the lesser of (a) the maximum rate of interest allowed by applicable law, or (b) 18% per annum” (Sec. 1.1(10), p. 2) – https://mega.nz/file/AI0iUYga#QzMtaBd0iRTZJ_YNmh2KZ1xKu7Qh_hQ6IcPMVkGWX94; &

(b) these facts prove that General Counsel Arthur Schwartz was mistaken when he denied at the 5Jan2023 PNB – so 5days after date due, at 2210 EST – that Pacifica had defaulted on the FJC loan by missing the 31Dec2022 quarterly interest payment. Referring to the odious Christina ‘Nurse Ratched’ Huggins, Chair of the KPFA LSB, he asserted, offering no evidence: “she said that we defaulted: that’s not true, we didn’t default, and the payment will get made and that has been worked out with FJC, and I will report on that more at – in the closed session” (1:31:00, emphases added; the meet started at “8.39pm on the East Coast” (Chair Julie Clueless, 0:03)) – https://kpftx.org/archives/pnb/pnb230105/pnb230105a.mp3

#9: through lack of payment, FJC has charged 18% interest since April 1. Interest at 18% annualizes as $486K (at $80K, that’s 6 full-time employees). Why haven’t you disclosed these facts?

(a) The missed 2023 FJC quarterly interest payments fell due on 31Mar & 30June – with that of 30Sep set to join them (the loan was signed 2Apr2018, & the Pacifica meets always talk about the payments falling due at the end of each Pacifica fiscal quarter, corroborated by the postings in the PNO monthly net income statements) … a quarterly payment @ 18% = $ 2.7m x 0.18 x (3 ÷ 12) = $121 500. This contrasts with Pacifica, since the beginning of the year, being unable to find even $8 731 a month to pay the EIDL (sic). (One needs to use the elliptical ‘since the beginning of the year’ coz the period has never been disclosed by the high guardians of Pacifica’s secrecy culture, ED Wells & the 21 directors sleepwalkers.);

(b) note, there is one statement on the record, by no less than PNB Finance Cttee Chair James Sagurton, that the quarterly interest payment due 31Dec2022 (as well as that of 31Mar2023) was still unpaid at 10May2023 when he spoke at the WBAI LSB (remark made at c. 2040 EDT; still no audio recording in the meetings archive (sic) – https://kpftx.org/archive.php . . . [UPDATE: still missing as of Su10Sep (sic). … UPDATE OF THE UPDATE: the audio was eventually posted in early-mid Dec. The Sagurton quote, stating it no less than three times: “we’re two, we’re two payments behind – we’re two quarterly payments behind on the FJC loan” (from 1:26:50, at 1:28:09) – https://us02web.zoom.us/rec/share/TH_Xn-oT6pneGV2F41zUxiGjKmOB8_80Ql6gfX0LLK4SLE-eMd05ReXEkvB9KoAp.QjYv9jXEN21oPsok?startTime=1683760465000, passcode: ntuT+as4. Why this link, rather than one starting ‘kpftx.org’? Privatisation – Pacifica going all ‘neo-liberal’, as the geo-historically ignorant put it. It seems the WBAI LSB Secretary, Kay Williams, is doing something quite improper, using her own Zoom account for the meetings – so she’s in control: she decides whether the record button is pressed; she possesses the recording. (Although, of course, any attendee can make a recording on their own device.) Ultimate responsibility for this sloppiness lies with the LSB Chair, DeeDee Halleck – no doubt she’ll never be held to account, but that’s largely down to whether a delegate cares. (In an early Dec national meet, some directors mused out loud about this privatisation, even calling for an inventory of the practice – but don’t hold yer breath.) Although the richer part of the world has had efficacious COVID-19 vaccines since Dec2020, allowing a safe return to in-person meetings, that hasn’t happened to PacificaWorld – even after three long years.]; &

(c) @ 18%, the FJC annual interest charge = $2.7m x 0.18 = $486k (sic).

#10: the California charities registry declares (even today), for any prospective donor to see, that Pacifica is delinquent. At the August 17 board meeting, you said this isn’t true, and that the registrar was simply tardy – although you cited neither a document nor a date of curing. You also agreed to put a statement of non-delinquency on the homepage of Pacifica’s website. You haven’t done this. Is it because Pacifica actually is delinquent, for a reason other than paying last August the wrong annual registration fee?

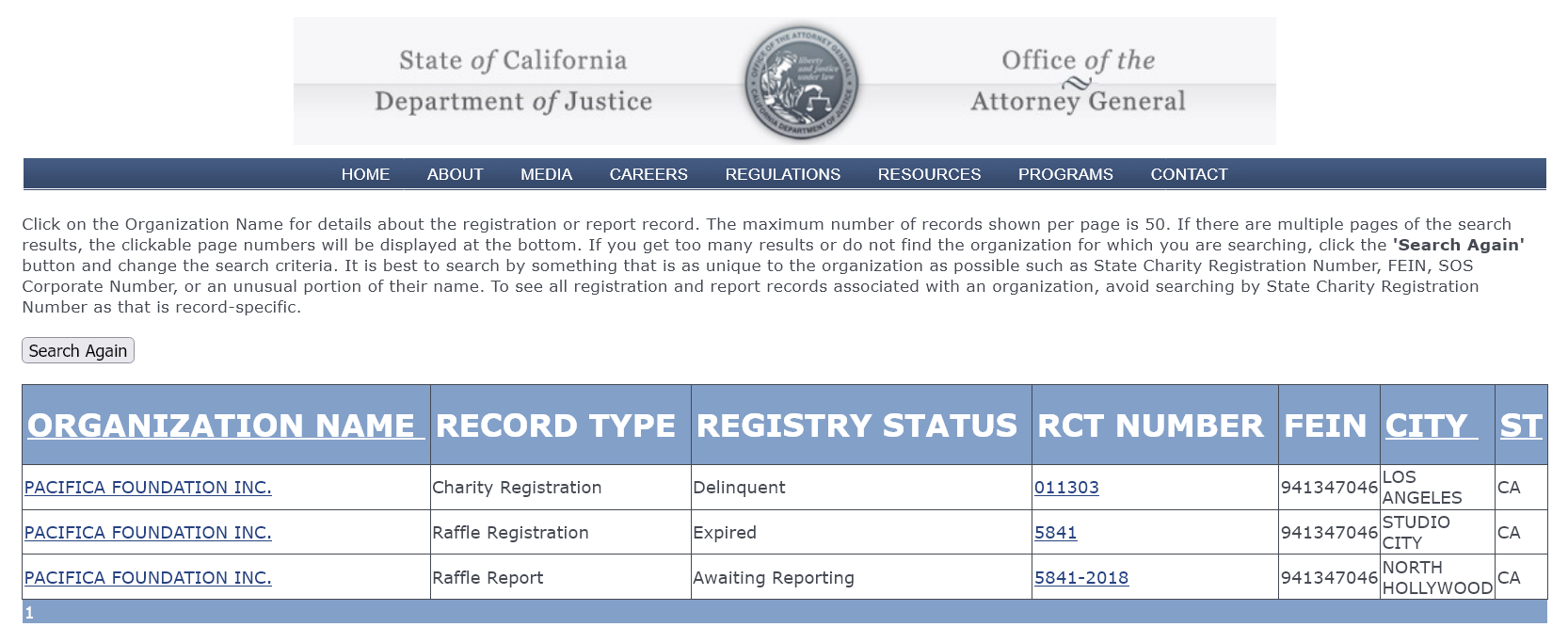

(a) Pacifica Foundation, Inc. is delinquent with the CA Charitable Trusts Section, Attorney General’s Office: see the Registry of Charitable Trusts, https://rct.doj.ca.gov/Verification/Web/Search.aspx?facility=Y (pump in ‘Pacifica Foundation’). [UPDATE: still delinquent as of Su10Sep (sic) … UPDATE OF THE UPDATE: ditto as of Sa16Dec (double sic).]

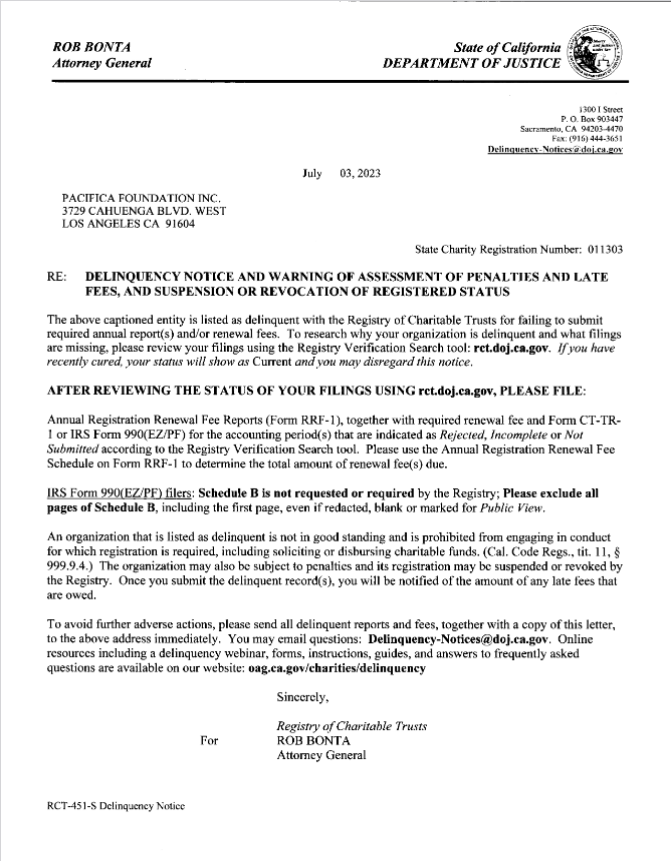

Besides the declaration “Delinquent” appearing on two separate webpages of the CA Attorney General’s site, the delinquency notice itself is a letter dated 3July, a ‘451’, “RCT-451-S Delinquency Notice – 1st”, bearing the subject line, “DELINQUENCY NOTICE AND WARNING OF ASSESSMENT OF PENALTIES AND LATE FEES, AND SUSPENSION OR REVOCATION OF REGISTERED STATUS” (original bold & caps) – it’s in the Registry depository just linked, & on the generated webpage it’s at the bottom of Filings & Correspondence;

(b) the matter came up towards the end of the 17Aug PNB, with Chair Julie Clueless asking ED Steph – and her agreeing – to post a statement of non-delinquency on Pacifica’s homepage (2:51:35 & 2:53:50) – https://kpftx.org/archives/pnb/pnb230817/pnb230817a.mp3, & https://pacifica.org [UPDATE: still not posted as of Su10Sep – 3½wks later (sic) … the joys of an organisation without accountability & scrutiny from within. … UPDATE OF THE UPDATE: ditto as of Sa16Dec (double sic).]; &

(c) ‘The Breeze’ has repeatedly got her fee figures mixed up when trying to explain why the wrong amount was paid for Pacifica’s annual registration renewal as a charity incorporated in California. She keeps talking about having paid $400 when she didn’t realise that the fee had been raised to $575; she said this, for example, at the 17Aug PNB just mentioned (2:51:46). [UPDATE: she’s done this four times in public to the knowledge of the minions; the latest being the 7Sep PNB – audio recording not yet at the meetings archive as of Su10Sep.] PacificaWatch reported the matter correctly on 4May2023, quoting the statement in the CA Registry of Charitable Trusts: the amount paid was $225 when the fee was actually $400, leaving $175 owed. The CA Charitable Trusts Section had upped its fees, & the webpage said, “[u]pdated forms are available for download and are required with any filings received by the Registry on or after January 1, 2022 […] please always download the latest forms available” (all original emphases). So ‘The Breeze’ was mistaken in asserting “that [the form used] just happened to be the form that was on the website that they had” (2:52:33) – https://pacificaradiowatch.home.blog/2023/05/04/recommending-ed-wells-to-pnb-as-the-so-called-interim-nes-w3may2023-pnb-elections-cttee-plus-missing-audio/ (2nd section); https://oag.ca.gov/charities/forms

[UPDATE: sure enough, Pacifica was sent a second delinquency notice, a ‘451A’, dated 15Sep – that’s what happens when a delinquency isn’t cured. In the depository, it’s next to the first notice, & denoted “RCT-451A-S Delinquency Notice – 2nd”.]

#11: the Los Angeles land and building were removed from escrow two weeks ago. Why have you never disclosed this, not least in your public reports to both the board on August 17 and the board’s Finance Committee on August 8 and 22?

Re the Los Angeles land and building being removed from escrow in early Aug, the mice have been gnawing at the PacificaWatch archive, making a mess of invaluable records, but this was stated perhaps by KPFK Treasurer Kim Kaufman at the Su20Aug KPFK LSB (no audio recording posted) [UPDATE: not posted as of Su10Sep.].

~

And remember people, as the conspiracy nutz at WBAI know full well, we’re doing all this for the children.

~~~